Lenme is a peer-to-peer lending app designed to simplify the loan process for borrowers and investors. It connects individuals, businesses, and other entities looking for quick and convenient financing with investors willing to lend money. Here are the top and best 8 Apps like Lenme in 2023 you can consider.

Although Lenme is advantageous in its convenience and simplicity, it does have some drawbacks.

- Firstly, borrowers may not qualify for as low of rates as they would if they applied through traditional banking institutions due to Lenme’s origination fee.

- Secondly, unlike many regular credit cards, borrowing from Lenme does not improve a person’s credit score because payments made through the app are not reported to credit bureaus.

Fortunately, there are several Lenme alternatives from which people can choose when seeking alternative financing or investments. Many alternative apps provide lower borrowing rates without an origination fee while reporting payment activity to the three major credit bureaus.

Most apps also feature additional services such as budgeting tools and automated notifications to help keep investors and borrowers on track in regard to their finances. With such alternatives available, it pays off to research and compares options before diving into peer-to-peer lending platforms like Lenme.

List of Apps Like Lenme/ Lenme Alternatives

1) Solo Funds

Solo Funds is one of the most popular microloan apps you can think of. It provides a fast, easy, and reliable way for people to access funds for immediate needs. As borrowers, users can select their own repayment terms and dates and enter the purpose of applying for the loan. This app operates on a short-term basis, with most loans having a repayment period of 30 days or shorter.

In addition to being a borrower, Solo Funds also offers an opportunity to become a lender by setting personal caps and selecting how much weight each factor is given when deciding who gets prequalified. As mentioned before, it must be noted that you cannot be both a borrower and lender simultaneously on this platform; nevertheless, lenders still benefit from this app by earning interest and getting exposure to low-risk borrowers with excellent credit ratings.

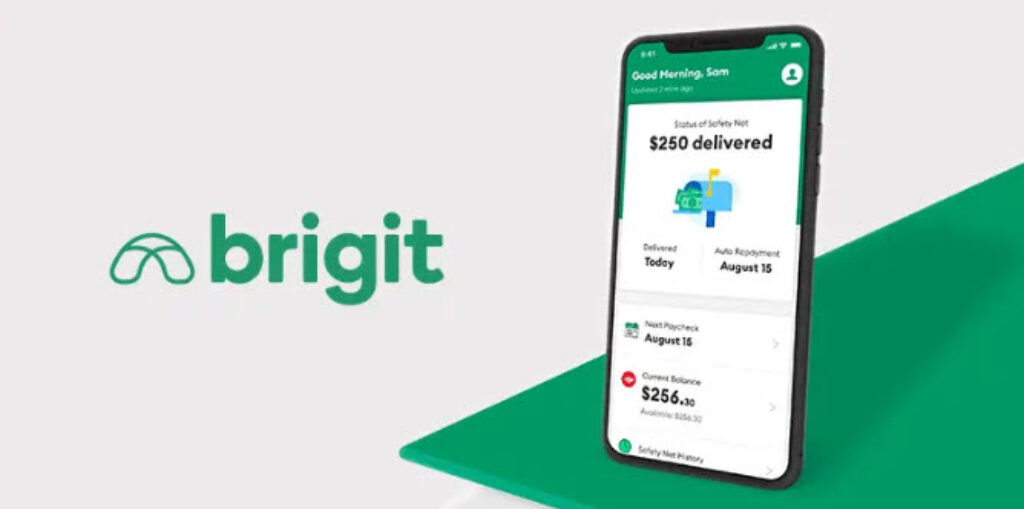

2) Brigit

Brigit is an alternative to Lenme and one of the most popular apps for financial management. It uses analytics to monitor your spending, helping you stay within your budget. With over 3 million users, Brigit allows you to get funds up to $250 with no minimum credit score requirement, making it a great alternative if you are low on cash or need access to extra funds.

The app also has a convenient notification feature that will alert you whenever you overspend on a certain category- that way; it can help you recognize and prevent potentially bad spending habits. Additionally, the cash advance feature costs only $9.99 per month, making it much cheaper than other loan options while allowing users to save up to $514 annually. All of this is wrapped together into one free-to-download package, making it well worth checking out for anyone looking for a reliable financial service provider.

3) EarnIn

EarnIn is a revolutionary new app designed to give users financially secure access to their earned wages. It’s an incredibly beneficial alternative for those seeking emergency cash on short notice or when payday may be far away. With Earnin, you can get your paycheck in advance and receive your money the same day as you’ve worked, all at no fees. Their no minimum credit score makes applying for this cash loan easy without worries.

If you ever need extra funds during pay periods, the Cash Out feature within Earnin gives you up to $100 per day and $500 each pay period just by using the app! In addition, the Balance Shield feature allows you to link your bank account so that if your balance ever falls below a certain amount, they’ll alert you and even transfer money into your account. No more panicking about dropping bank accounts at the end of the month! This comprehensive feature helps people stay within healthy budget limits while still having access to the needed cash quickly.

4) Zirtue

Zirtue is a popular peer-to-peer lending app that makes the process easy and straightforward. It is an excellent alternative to Solo Funds and Lenme, allowing lenders to lend their money securely and with peace of mind. Zirtue has Android and iOS apps, so people can comfortably carry out this transaction on their phones or tablet.

With Zirtue, borrowers can choose whom they want to lend from instead of going through multiple intermediaries, making the whole process faster and less tiring. Furthermore, the automated payment system enables lenders to return their money when due without issues.

The app also comes with great transparency features that allow users to have full control over their fund transfers – they can view whom they’ve lent money to and track payments in real-time as well as apply different filters to search for specific groups or individuals who would suit them best in terms of lending.

5) Hundy

Hundy is another peer-to-peer lending app that provides quick cash advances to people who need them. It’s similar to other apps like Solo Funds in that it allows members to borrow money from other members up to $250, with the loan repayment due on their next paycheck. The main difference between Hundy and Solo Funds is that Hundy only offers its service for Apple Appstore users, so if you’re looking for a loan from an Android app, then you’ll have to look elsewhere.

What sets Hundy apart from its competitors is that it has no late fees or hidden charges associated with its loans, making them more accessible and cost-effective. Additionally, borrowers can repay within multiple payments without any extra fees being charged as long as they’re all within three weeks of each other. On top of this, the app boasts a secure transaction system to protect borrowers’ personal information and privacy throughout the process of taking out loans and repaying them. This makes it a safer option than many of the other alternative loan sites that are available today.

6) Prosper

Prosper is a well-known peer-to-peer lending platform that helps individuals obtain personal loans and enables investors to generate investment returns. For borrowers, Prosper makes the loan process more accessible by using a unique rating system and an automated decision engine to approve eligible candidates quickly. By applying data points like debt-to-income ratio and credit history, Prosper makes it easy for borrowers with good credit scores to complete the loan application process and receive their funding as soon as the next business day.

Prosper offers plenty of attractive features for investors, including a fully automated auction platform where investors can compete with each other for loan investments. The platform allows lenders to view detailed information about the borrower, enabling them to make educated decisions regarding which loans are likely to offer better returns. Furthermore, each loan is fully secured with properties or assigned income streams so lenders and borrowers can feel secure in their transactions on Prosper.

7) Kiva

Kiva offers a unique approach to connecting lenders with low-income entrepreneurs and students needing loans. Through their online platform, potential borrowers can tell their personal stories to allow lenders to connect with them more easily. By doing this, Kiva offers a greater sense of connection than other lending apps offering access to capital.

Kiva also works alongside over 300 microfinance institutions, schools & non-profit organizations, and social impact businesses worldwide. Therefore, its mission is not only about offering loans – it’s about expanding financial access for people worldwide and helping them succeed.

The service specializes in providing low-interest rates, making it stand apart from traditional banks and other loan facilities. What truly sets it apart is its ability to bring together leaders worldwide and provide them with personally touching ways they can impact people’s lives through microfinance.

8) Chime

Chime is an excellent alternative to traditional banks, offering a Chime Visa card to be used anywhere Visa is accepted. With no annual fee and no interest rates associated with it, anyone can take advantage of its convenience without worrying about hidden costs or fees. As a bonus, there’s no need for a credit check when applying for a card from Chime.

It’s also incredibly easy to access the services of Chime: connect your existing bank account to the app, and you are good to go. It allows users to borrow money quickly and conveniently without dealing with tons of paperwork or long waiting periods. Plus, once you have the card, plenty of benefits come with it, such as rewards programs, cashback bonuses, and more. All in all, Chime makes borrowing money easier and far more secure than ever.

You May Ask: We Answered

Does Lenme affect credit score?

No, Lenme does not affect credit score. Lenme is a peer-to-peer lending platform that enables borrowers to easily access loans from individuals with money to lend out in exchange for an agreed-upon interest rate. This type of loan does not report to the major credit bureaus, so it does not impact your credit score.

Is Lenme a safe app?

Yes, Lenme is a safe app. It employs bank-level security technology and has undergone rigorous security audits to ensure your financial and personal data stays secure when using Lenme’s services.

How much does Lenme cost?

The cost of Lenme varies depending on the agreement you make in terms of services. Generally, Lenme offers three monthly plans ranging from $9.99 to $39.99.

Many apps like Lenme available in 2023, can help borrowers and lenders make financial transactions more convenient. From Kiva’s mission to expand financial access for people worldwide to Chime’s no-interest Visa card, these services offer various options for those looking to borrow or lend money. Furthermore, with Lenme’s bank-level security and no credit score impact, it is a safe and reliable option for those looking to take advantage of the convenience that peer-to-peer lending offers.